The new customer credit application form is a streamlined document designed to simplify the credit approval process. It ensures accuracy and efficiency, helping lenders assess creditworthiness effectively.

1.1 Understanding the Purpose of the Form

The new customer credit application form is designed to collect essential information about potential borrowers. It helps lenders evaluate creditworthiness by gathering details about income, employment, and financial history. The form ensures transparency and fairness in the credit approval process. By providing accurate personal, financial, and employment data, applicants enable lenders to assess risk and make informed decisions. This streamlined process aims to simplify credit evaluation while maintaining rigorous standards for approval.

1.2 Importance of Accuracy in the Application Process

Accuracy is crucial when completing the new customer credit application form. Incomplete or incorrect information can lead to delays in processing or even rejection of the application. Lenders rely on the data provided to assess creditworthiness and make informed decisions. Errors or omissions may result in a lower credit score or increased scrutiny. Ensuring all details are correct fosters trust and streamlines the approval process. Applicants should double-check personal, financial, and employment information before submission to avoid potential issues.

Required Documents for the Credit Application

The credit application requires specific documents, including personal identification, proof of address, financial statements, and employment details. These documents help verify identity and assess creditworthiness.

2.1 Personal Identification and Proof of Address

The credit application requires valid personal identification, such as a passport, driver’s license, or national ID, to verify the applicant’s identity. Additionally, proof of address, like a utility bill or bank statement, must be provided to confirm residency. These documents ensure the lender can authenticate the applicant’s details and assess their creditworthiness accurately. Submitting current and valid paperwork helps avoid delays in processing the application.

2.2 Financial Statements and Income Verification

Financial statements and income verification are critical for assessing creditworthiness. Applicants must provide recent payslips, bank statements, or tax returns to confirm their income. Additional documentation, such as W-2 forms or letters from employers, may be required. These records help lenders evaluate the applicant’s financial stability and ability to repay the credit. Ensuring all documents are accurate and up-to-date is essential for a smooth approval process.

2.3 Employment Details and Credit History

Applicants must provide detailed employment information, including current job status, employer name, and duration of employment. Additionally, a comprehensive credit history is required to assess financial responsibility. This includes credit scores, past loans, and any outstanding debts. Lenders use this data to evaluate the applicant’s ability to manage credit and repay obligations. Accurate employment and credit history ensure a thorough evaluation of creditworthiness, helping lenders make informed decisions. This step is crucial for determining eligibility and terms of credit approval.

Eligibility Criteria for Credit Approval

Credit approval depends on factors like credit score, debt-to-income ratio, and financial stability. Lenders evaluate these metrics to determine an applicant’s ability to repay credit responsibly.

3.1 Credit Score and Its Impact

A credit score is a critical factor in determining creditworthiness, typically ranging from 300 to 900. Higher scores indicate better financial health, increasing approval chances and lowering interest rates. Lenders use this score to assess risk, with scores below 600 often considered subprime. Factors like payment history, debt levels, and credit history influence the score; Monitoring and improving it can enhance loan terms and approval likelihood. A good score demonstrates financial responsibility, making it easier to secure credit.

3.2 Debt-to-Income Ratio and Financial Stability

The debt-to-income (DTI) ratio measures monthly debt payments relative to income, assessing financial stability. Lenders prefer a lower DTI, as it indicates better ability to manage additional debt. A high DTI may signal financial strain, reducing approval chances. Typically, a DTI below 36% is considered favorable, while exceeding 43% can lead to rejection. Accurate income and debt reporting is crucial, as this ratio significantly influences credit decisions and terms offered by lenders. Maintaining a healthy DTI improves overall financial health and creditworthiness.

Completing the Application Form

Fill in all sections accurately, ensuring completeness and legibility. Provide required documents and verify details before submission to avoid delays. Adhere to the specified guidelines carefully.

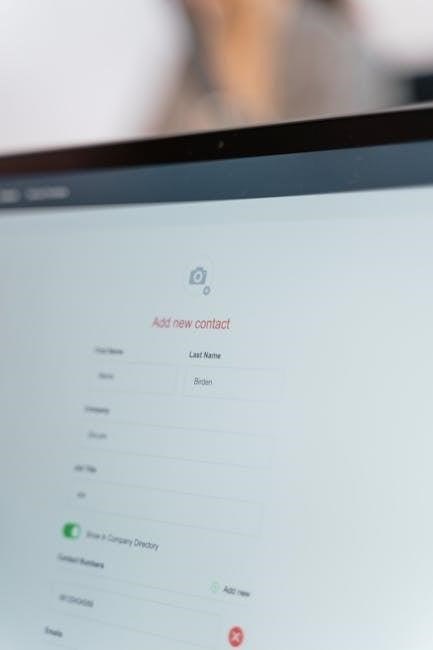

4.1 Step-by-Step Guide to Filling Out the Form

Start by entering your personal details, including full name, address, and contact information. Next, provide employment and income information, ensuring accuracy. Attach required documents like proof of identity, address, and financial statements. Review each section to avoid incomplete or incorrect entries. Ensure all signatures are included where necessary. Finally, submit the form and retain a copy for your records. Double-check all details to prevent delays in processing your credit application.

4.2 Submitting the Application and Next Steps

Once completed, submit the application via the specified method, such as online upload, mail, or in-person delivery. Processing typically begins within 24-48 hours. Lenders may contact you for additional verification. After submission, monitor your email or online portal for updates. Upon approval, review and sign the credit agreement. If denied, request feedback to improve future applications. Tracking your application status ensures a smooth process. Stay informed and follow up if necessary to avoid delays in credit approval.

Common Mistakes to Avoid

Common mistakes include submitting incomplete or incorrect information and ignoring credit history red flags. These errors can delay approval or lead to rejection.

5.1 Incomplete or Incorrect Information

Submitting an application with incomplete or incorrect information is a common mistake that can delay processing or lead to rejection. Ensure all sections are filled accurately, as missing details may result in additional verification steps. Double-check personal data, financial figures, and employment history for accuracy. Even minor errors, such as mismatched addresses or incorrect dates, can cause issues. Always review the form thoroughly before submission to avoid unnecessary complications. This step is crucial for a smooth credit application experience.

5.2 Ignoring Credit History Red Flags

Ignoring credit history red flags, such as late payments, high debt levels, or past defaults, can significantly harm your credit application. Lenders carefully review credit reports to assess risk, and unaddressed issues may lead to rejection or less favorable terms. It’s crucial to review your credit history beforehand and resolve any discrepancies or outstanding debts. Addressing these concerns proactively can improve your chances of approval and ensure a smoother application process. A clean credit record demonstrates financial responsibility and increases credibility with lenders.

The Role of Customer Service in the Application Process

Customer service plays a vital role in guiding applicants through the credit form process. Representatives provide assistance, address concerns, and ensure a smooth experience, fostering trust and satisfaction.

6.1 Assistance with Form Completion

Customer service teams are available to assist with completing the credit application form. They provide clarity on complex sections, address questions, and ensure all required fields are accurately filled. Representatives can guide applicants through confusing parts, such as income verification or credit history details, and help resolve issues like incomplete sections or unclear instructions. This support ensures the application is submitted correctly, reducing delays and improving the overall experience.

6.2 Addressing Customer Concerns and Queries

Customer service plays a crucial role in resolving applicant concerns promptly and effectively. Representatives are trained to address questions about form sections, required documents, or eligibility criteria. They provide empathetic support, ensuring applicants feel reassured throughout the process. Whether it’s clarifying credit score requirements or explaining debt-to-income ratios, the team offers clear, concise solutions. This proactive approach minimizes delays and ensures a smooth application experience, fostering trust and satisfaction.

The new customer credit application form streamlines approval processes, ensuring efficiency and accuracy. Thorough preparation and understanding creditworthiness lead to a smooth experience. Seek assistance if needed.

7.1 Final Tips for a Smooth Application Experience

To ensure a seamless credit application process, review the form carefully before submission. Verify all personal and financial details for accuracy. Gather required documents in advance to avoid delays. Utilize customer service for clarification on any complex sections. Understanding your credit history and financial stability beforehand can improve approval chances; Double-check the submission process and follow up if necessary. A well-prepared application enhances your likelihood of a positive outcome.